IBEA’s Payment Automation Services Supports Saudi SMEs

January 5, 2025

Unlock Hidden Revenue with Dynamic Discounting: A Win-Win for Buyers and Suppliers in Saudi Arabia

February 25, 2025Why dynamic discounting is growing 300% faster than any other form of supply chain financing

Dynamic discounting is quickly surging ahead as a preferred method of supply chain financing, outpacing traditional approaches by a staggering 300%. but what is dynamic discounting? And what made it the preferred solution for SCF?

Dynamic discounting is a financial arrangement for early payment in exchange for a discount on the invoice amount. In this model, the buyer takes the initiative by proposing a range of discount percentages tied to different early payment dates for each invoice. This approach empowers suppliers to choose the payment date and discount level that best fits their cash flow needs.

Here’s how it works:

- Buyer Proposals: The buyer offers multiple early payment options for each invoice, each associated with a specific discount percentage.

- Supplier Flexibility: Suppliers review the options and select the date and discount percentage that maximizes their financial benefit.

- Customized Terms: This negotiation process results in a tailored agreement that accommodates the cash flow priorities of both parties, fostering a mutually beneficial relationship.

The discount provided can be fixed or varying. In fixed discount, the buyer can pay anytime within the agreed time frame and enjoy a fixed discount. In varying discount, the percentage of discount reduces as the time passes. The earlier the payment done, the higher is the discount. Dynamic discounting typically applied on an invoice-by-invoice basis, with the discount generally expressed as a percentage of the payable value of the invoice.

Flexibility and Control

The buyer-led dynamic discounting model offers unprecedented flexibility and control. Buyers set the framework by proposing a range of early payment options, while suppliers have the freedom to choose the most advantageous terms. This dynamic negotiation ensures that both parties can optimize their cash flow without being locked into rigid, one-size-fits-all financing solutions.

Technology Integration

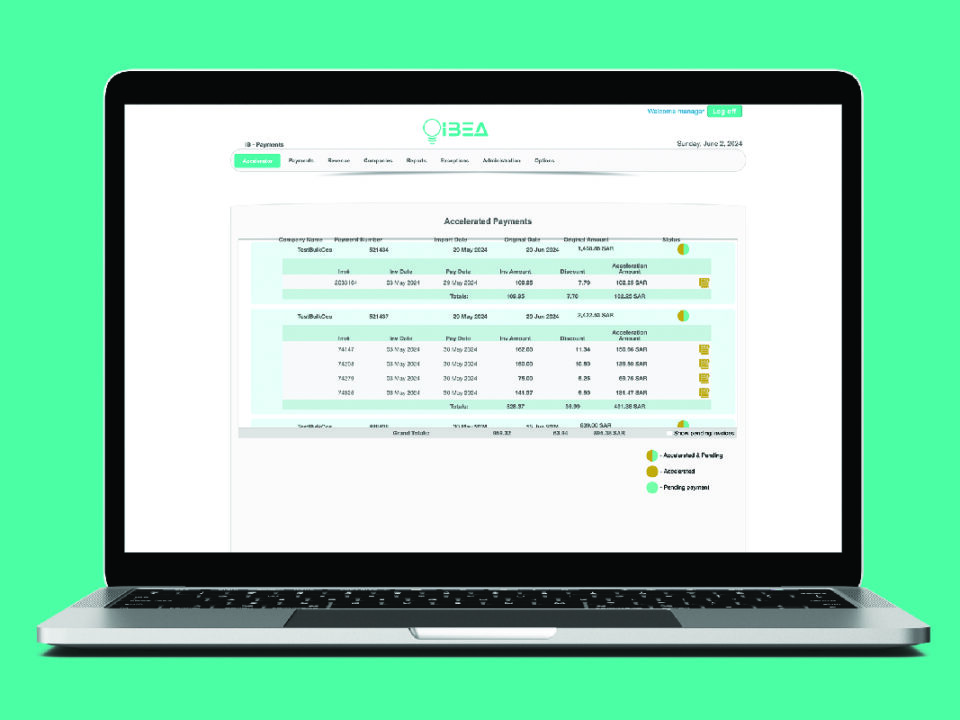

The rapid evolution of fintech and automation platforms—exemplified by IBEA—has transformed the dynamic discounting process, making it more accessible and efficient than ever before. These cutting-edge automated systems, like IBEA, significantly reduce administrative burdens while enhancing accuracy, providing companies with a streamlined solution to optimize cash management and improve overall financial operations.

Cash Flow Optimization

As businesses strive to maintain healthy cash flow, dynamic discounting serves as a strategic tool. Companies can retain liquidity while offering suppliers immediate access to cash, fostering better relationships and improving supply chain resilience.

Data-Driven Decision Making

Dynamic discounting strategies are increasingly driven by advanced analytics and insights. Companies can leverage data to assess their liquidity positions and supplier performance, facilitating informed decisions that lead to more favorable payment terms. This data-driven approach enhances overall financial efficiency and helps organizations better navigate the complexities of supply chain financing.

Strengthening Supplier Relationships

In today’s competitive business environment, fostering strong supplier relationships is critical. Dynamic discounting not only supports suppliers by providing earlier access to cash but also builds loyalty and encourages collaboration. By aligning the interests of both buyers and suppliers, dynamic discounting contributes to a more stable and efficient supply chain network.

How dynamic discounting benefits SCF

With the increase in adoption of dynamic discounting in recent times, the Global Supply Chain Finance Forum recognized it as one of the key supply chain finance techniques in their “2021-GSCFF-Enhancement-of-the-Standard-Definition” report. It was introduced in a new category of ‘Advanced Payable” wherein the buyer may utilize its own funds to pay an invoice or payable prior to the original due date. This means that dynamic discounting is widely accepted and is used as an important tool in trade. Banks are also increasingly looking for supply chain finance solutions with dynamic discounting capabilities due to rising demand from corporates.

Dynamic discounting's combination of flexibility, technological integration, and cash flow optimization makes it a powerful tool for modern businesses. As companies seek innovative ways to enhance their supply chain financing strategies, dynamic discounting offers a clear competitive advantage.

Don't miss the opportunity to see how dynamic discounting can benefit your company! Visit our website www.ibea.com to learn more or simply request a free demo.