Why dynamic discounting is growing 300% faster than any other form of supply chain financing

February 5, 2025Unlock Bigger Discounts with Dynamic Discounting: A Win-Win for Buyers and Suppliers in Saudi Arabia

The landscape of finance and business is evolving rapidly, especially in Saudi Arabia. Suppliers in Saudi Arabia and the GCC are under constant pressure to maintain smooth operations, while lacking the funding and taking on third party finance solutions and loans. As cash flow pressure mounts for suppliers and interest rates on loans climb, dynamic discounting emerges as a powerful tool that benefits both buyers and suppliers.

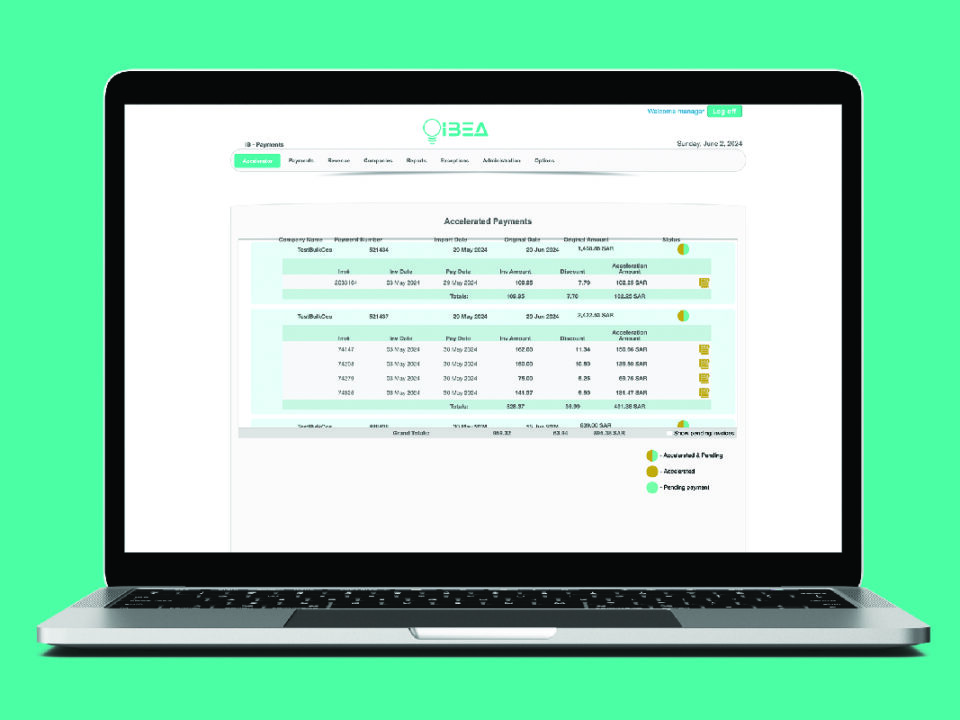

Dynamic discounting does not only provide a better alternative to solve supply chain finance issues, but it’s also a win-win solution for both buyers and suppliers. It provides buyers with a golden opportunity to generate revenue through their accounts payable by making early payments to their suppliers in exchange for a discount. How? Simple, through IBEA’s dynamic discounting solution.

So, what exactly is dynamic discounting, and why should you care?

At its core, dynamic discounting is a win-win strategy where buyers offer early payment to suppliers in exchange for a discount on invoices. The term dynamic comes from the flexibility it offers the buyers on the rate accepted on the discount depending on how early suppliers would like to be paid. Once suppliers are given the opportunity to pay early, buyers can capture and consider these discounted rates as revenue to be added to the company’s bottom line. And in today’s market, these discounts can be far greater than the rates you’ll get through traditional financing and investment options.

Will suppliers provide significant discounts?

Suppliers are facing increased pressure due to the long cash conversion cycles and ongoing economic volatility. With rising costs and squeezed margins, many suppliers are desperate for a steady cash flow to keep their operations running smoothly. Here’s where early payment becomes a game-changer. Rather than waiting 30, 60, or even 90 days to get paid, IBEA allows you to offer your suppliers an early payment method to help solve their cash flow problems instantly. In return, suppliers are willing to offer you significant discounts – even more attractive than other investments.

Why go for Dynamic Discounting?

In Saudi Arabia, loan interest rates are currently on the rise, making bank financing more expensive and less accessible for many businesses. As a result, many suppliers are turning to buyers for relief, rather than depending on traditional bank loans.

When a supplier needs cash to cover operational expenses but can’t get a low-interest loan, dynamic discounting becomes an ideal solution. Instead of paying high interest to a bank, suppliers are offering larger discounts to buyers like you—providing you with a win-win opportunity that banks simply can’t match.

In this scenario, dynamic discounting provides suppliers with much-needed liquidity, and you get a much higher discount than you would through traditional financing. As a buyer, dynamic discounting offers significant advantages:

- Capture Greater Discounts: Offering suppliers to pay early you will be able to leverage your suppliers' relationships to secure greater discount rates that would otherwise be unavailable through traditional financing.

- Cost Savings: dynamic discounting comes with an automated payments cycles that allows you to save on every payment, improve your margins and optimize your cashflow.

- Stronger Supplier Relationships: enabling dynamic discounting will solve the cash flow issues and financial storms suppliers often struggle with, which will build trust and foster long-term relationships.

- Better Cash Flow Management: You can align your payments and discounts with your cash flow cycles to maximize savings and operational efficiency.

It’s a simple equation: the supplier gets immediate cash, and you generate revenue and automate payments in the process.

Leverage Market Volatility to Your Advantage with Dynamic Discounting

Dynamic discounting excels in today's challenging economic landscape, providing a viable solution for both buyers and suppliers. It effectively bridges the gap in supply chain finance, allowing both parties to benefit and thrive. The current volatile market conditions are causing suppliers to face challenges like never before: long cash conversion cycles, high production costs, and unpredictable demand make it difficult for suppliers to maintain consistent cash flow.

One of the biggest reasons why dynamic discounting is taking off in Saudi Arabia and the GCC is because it's an alternative solution to the high interests of loans and third-party supply chain finance solutions. It’s time to be on the winning side with IBEA and start enjoying better terms and greater discounts.

IBEA's dynamic discounting solution is here to provide you with an incredible opportunity to optimize your cash flow needs and add revenue to your bottom line by simply offering to pay early. The more flexible and quicker the payments, the greater the discount captured. Share your supplier’s burden of cash flow issues in today’s economy and gain a new stream to generate revenue that is better than rates of investments offered by the banks.

Embrace dynamic discounting and start generating revenue withing weeks. Request your demo today and start watching your payables generate revenue!

Making your business stronger and more resilient in today’s dynamic market.