10 Reasons Why IBEA Dynamic Discounting is Better than other Supply Finance Solutions!

December 1, 2024

IBEA Collaborates with CFO Summit to Dynamic Discounting In The Saudi Market

December 17, 2024Understanding the Differences: Dynamic Discounting vs. Invoice Financing

In today's fast-paced business environment, managing cash flow efficiently is crucial for sustainability. Two financial strategies that have gained traction are dynamic discounting and reverse factoring. While they both aim to optimize working capital and strengthen supplier relationships, they operate on different principles.

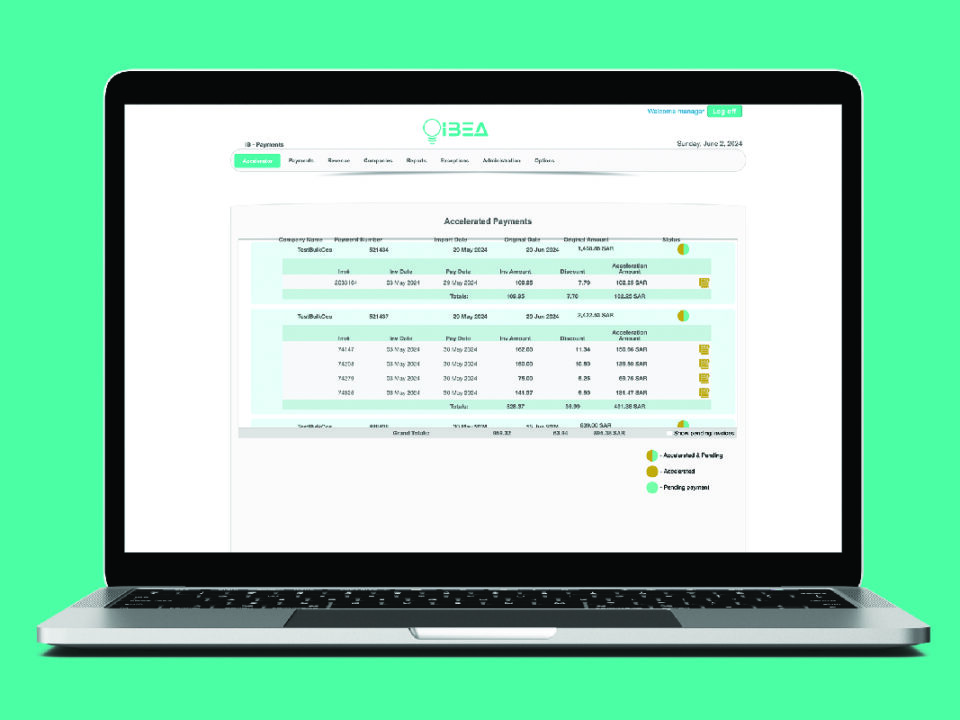

Dynamic Discounting is a financial strategy solution in accounts payable where buyers offer suppliers early payment of invoices in exchange for a discount. The "dynamic" aspect refers to the flexibility of the discount rate, which is calculated based on how early the payment is made. The earlier the payment, the greater the discount the buyer receives, benefiting both suppliers and buyers.

- Financed by the buyer rather than by a third-party finance provider

- Buyers gain an attractive risk-free return on their excess cash.

- Suppliers can receive early payment in exchange for a discount on their invoice

Key Differences:

- Stakeholders Involved: Dynamic discounting primarily involves the buyer and supplier, while reverse factoring introduces a financial institution into the process.

- Payment Timing: Dynamic discounting incentivizes early payment for discounts, whereas reverse factoring allows suppliers to receive immediate payment regardless of when the buyer pays back the financier.

- Cost Implications: Dynamic discounting may result in direct savings for both buyer and supplier through negotiated discounts. Reverse factoring may come with fees from the financial institution, but it also offers the convenience of immediate payment for suppliers.

Advantages of using Dynamic discounting

- For Buyers: Dynamic discounting can reduce costs and improve relationships with suppliers, while reverse factoring enhances supplier stability and can improve the buyer's balance sheet.

- For Suppliers: Dynamic discounting offers the potential for higher margins due to discounts, while reverse factoring ensures quicker access to funds, improving liquidity.

Dynamic discounting is an innovative financial solution that enhance supply chain efficiency and improve cash flow management for buyers and suppliers. Allowing suppliers to receive early payments in exchange for discounts on invoices, companies can strengthen their suppliers relationship while optimizing working capital and unlocking a new stream of revenue to buyers.

As organizations continue to adapt to rapidly changing market conditions, these strategies offer a competitive edge by increasing liquidity and reducing the financial strain on suppliers. Choosing between dynamic discounting and reverse factoring depends on a company’s cash flow needs and supplier relationships.

Embracing dynamic discounting can foster the health of supply chain ecosystem without the need of a third party involved, Book a free demo to discover how dynamic discounting can revolutionize your cash flow management.